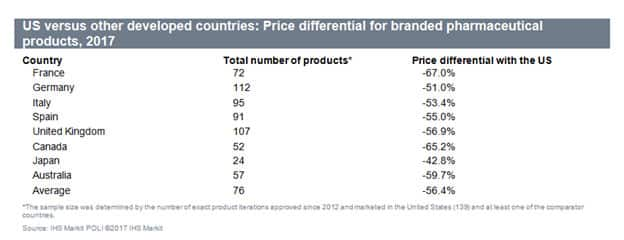

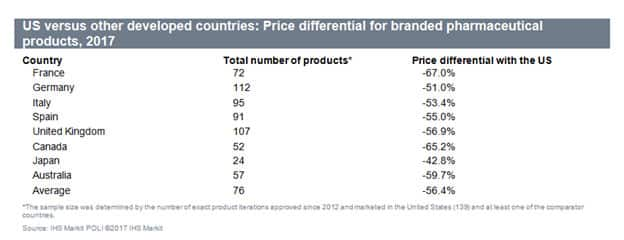

US pharmaceutical sales are expected to grow 7.6% in 2018 and reach US$469.96 billion. While growth is being driven by a strong macroeconomic recovery as well as the market entry of new speciality drugs – free market pricing continues to be an influencing, and controversial, factor. Free market pricing has led to elevated list prices for drugs which are generally the highest among all developed countries. Based on our analysis of prices in regulated markets, the United States paid on average more than 50% that other developed markets. Price discrepancies range from being one-third of the price in France to being just under two-thirds of the price in Japan. Prices for cardiovascular, musculoskeletal, and nervous system drugs were among the cheapest in other developed countries, averaging about 80% lower than in the United States. This has prompted a significant backlash from legislators and payors as media coverage of elevated pricing and high executive pay and compensation have brought more attention than most in the industry find comfortable.

US versus other developed countries: Pricdifferentialal tor branded pharmaceutical Products, 2017

Country

France

Germany

Italy

Spain

UK

Canada

Japan

Australia

Average

I-Ned

Total number of products•

72

112

107

24

57

Price differential with the US

-67

-51

.53

-55

.56

-65

-42

US versus other developed countries: Pricdifferentialal tor branded pharmaceutical Products, 2017

Country

France

Germany

Italy

Spain

UK

Canada

Japan

Australia

Average

I-Ned

Total number of products•

72

112

107

24

57

Price differential with the US

-67

-51

.53

-55

.56

-65

-42

The call for transparency in pricing

The net price actually paid by insurers and purchasers is much lower than the list price after accounting for discounts and rebates. However, these undisclosed discounts remain highly confidential and rarely come into consideration in the US pricing debate. Despite promises by US President Donald Trump to take action to lower pharmaceutical drug prices, the administration and Congress have not taken any steps forward besides encouraging "market-based" strategies, such as facilitating generic market entry, and it is unlikely that a Republican-led Congress would support any legislation that would control drug prices. In the absence of federal action regarding this issue, multiple states have so far passed legislation that would provide significant oversight, transparency, and/or control of pharmaceutical prices.

State legislation to tackle drug prices

States like California, Nevada, Maryland, and New York are implementing new legislation that seeks to provide transparency or indirect regulation of prescription drug prices. Congressional scrutiny over drug prices has created a highly volatile political climate, which has shown a strong spotlight on pharmaceutical pricing trends in the United States.

States advancing prescription-drug pricing legislation in 2017 Washjrgton Rhode Island Pennsytvania New York Montana SB 5586 - Require drug reets to esclose costs and profits HB 5323 - Identity up to 15 preschpbon drugs significant price increases cost the state the most HB 1464 - Establish a task force on dr'Æ pricing A02939 - Require makers to repott price increases mote nan T.•ee tines CPValW.v Medicaid to request rebates if prkes exceed HJ17 - Require drug makers to esclose list prices (WedYexamine trerds in pharmaceutcal pdcng durrg the past 10 years and spendirg by state programmes such as Medicaid Massachusets SB 627 - Requiresdrug makers to explain pee ircreases Maine Ilinois SP 484 - Require drug makers to explain ust price increases of 50% or mote over five years or 15% over 12 monts HB 0239 - Require makers to repott pree increases to state purchasers. heath hsuters. ard PBMs at 30 days advance

In October 2017, California signed into law SB 17, and it will probably pose the biggest threat to the industry as it requires, among other things, drug manufacturers to notify purchasers at least 60 days before increasing the list price of a prescription drug by more than 16% in a two-year period. All drugs with a Wholesale Acquisition Cost (WAC) of more than US$40.00 for a 30-day supply will be subject to the new legislation. Meanwhile, health plans and insurers must report on a number of factors and this data will then be compiled into a consumer-friendly report that highlights the overall effect of drug costs on healthcare premiums.

Maryland approved a new "price gouging" law (HB 631) targeted towards essential generic and off-patent products in May that would essentially serve to cap prices for certain products below a certain threshold. One of the requirements is that drug manufacturers with products that have realized a list price increase of greater than 50% during the course of one year to submit a statement to the Maryland Attorney General within 20 days explaining the reasons behind the rise. Although the law currently excludes patented products, the governor of the state, Larry Hogan, has stated that he would like to see more done for the state, particularly regarding this significant segment of the market that commonly includes the most expensive essential pharmaceutical drugs. Hogan has also added, "This issue is clearly one that can truly be addressed on a national, or even global level, given that the prescription-drug market cannot simply be changed by one state enacting legislation such as this." Despite its limitations, Maryland's law goes one step further than most transparency laws by including provisions that essentially cap price increases to below 50% annually, a strategy that would have been considered far too controversial to garner approval in the United States had the pharmaceutical pricing landscape not witnessed significant events during the past few years that have markedly affected public opinion of the industry.

Additional states, including Nevada and Vermont have also enacted drug-pricing legislation to date. The drug-transparency law passed last year in Vermont (S.216) requires drug manufacturers to justify price increases exceeding 50% over five years or 15% in a single year – if they place a substantial cost burden on the state – to the Attorney General's Office. They could face fines of up to US$10,000 if they fail to do so.

A greater awareness of drug prices outside the United States will substantially undermine pharmaceutical companies' position and could dampen the pharmaceutical sector; therefore, it is essential that the industry takes significant steps to address this rising concern before it represents a highly unfavorable turning point for the sector.

No comments:

Post a Comment